Our News

Our News

Wavebridge, in partnership with KBW organizer Factblock, has released a joint research report during the 2025 Korea Blockchain Week. The study highlights how Korea is transitioning from being a global retail powerhouse into a regulated financial infrastructure hub — with Bitcoin spot ETFs and KRW-based stablecoins at the center of this transformation.

The mood at KBW 2025 was clear: global capital is starting to see Korea differently. With nearly a decade of industry experience, Wavebridge observed a decisive shift in perception on the ground.

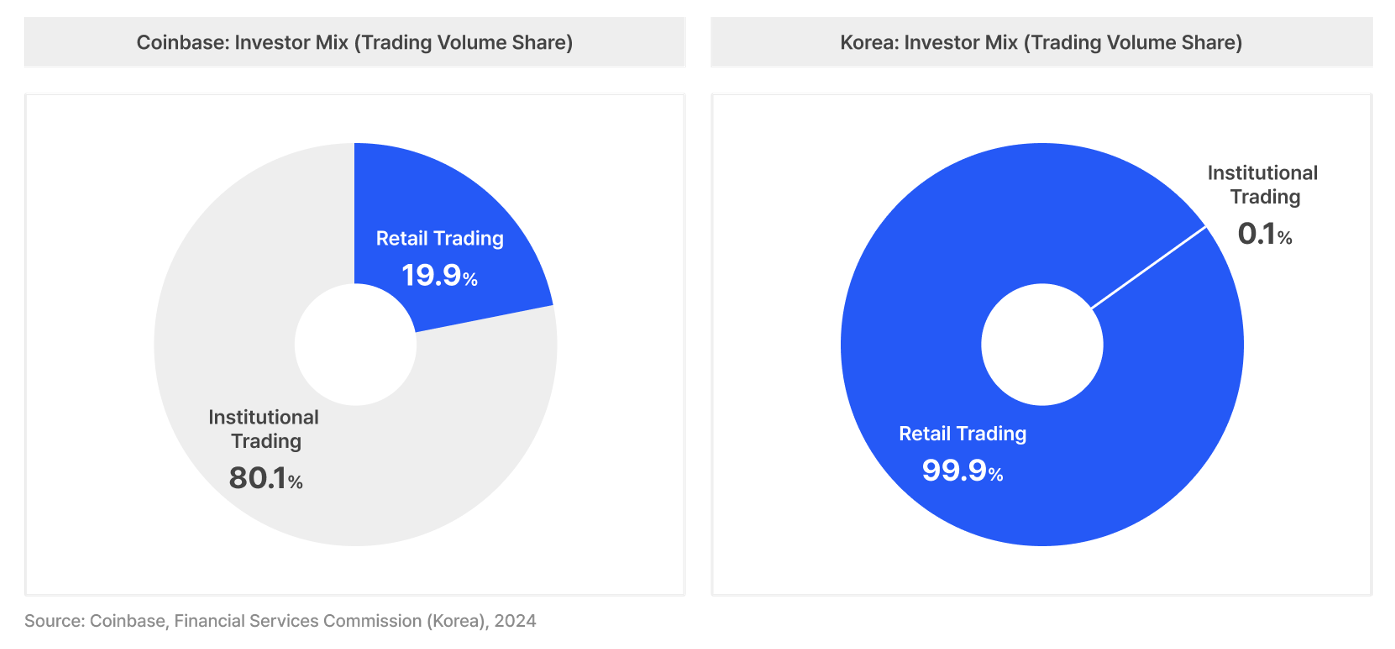

Korea was one of the first countries worldwide to implement real-name bank accounts for digital assets, taking the lead in regulatory soundness. Unlike other countries where institutional capital has driven adoption, Korea’s market has been fueled by direct retail demand in KRW, generating over KRW 2,500 trillion(USD 1.8 trillion) in annual spot trading volume.

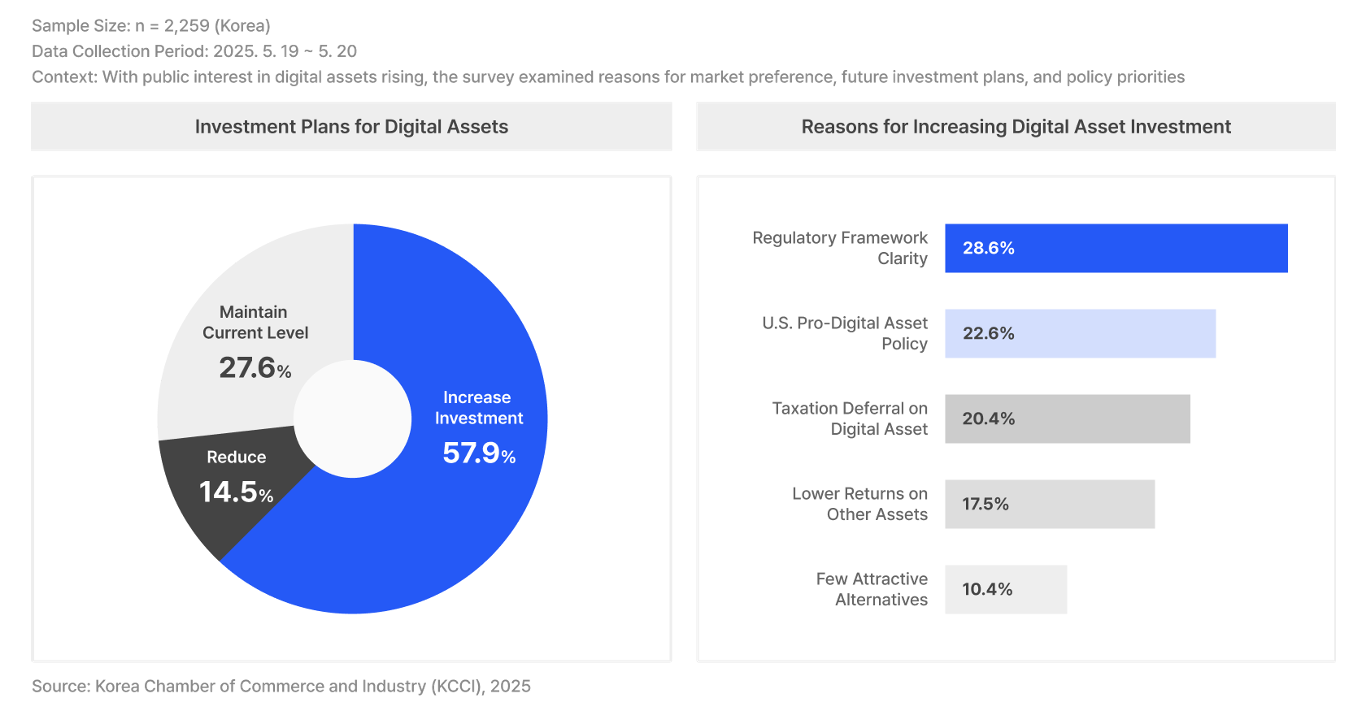

This has created a robust ecosystem encompassing AML and investor protection frameworks, high-performance trading infrastructure, and legal, accounting, and tax expertise — positioning Korea as a global benchmark. Today, 9.7 million Koreans (32% of the population) are active crypto investors, nearly 4.7 times the global average ownership rate (6.8%). A recent survey also showed that 57.9% plan to increase their investments, with the top reason cited as “regulatory clarity on the horizon” (28.6%).

In other words, Korea’s market is maturing beyond speculation, underpinned by strong retail demand and regulatory stability. And two themes stand out: Bitcoin spot ETFs and KRW-based stablecoins.

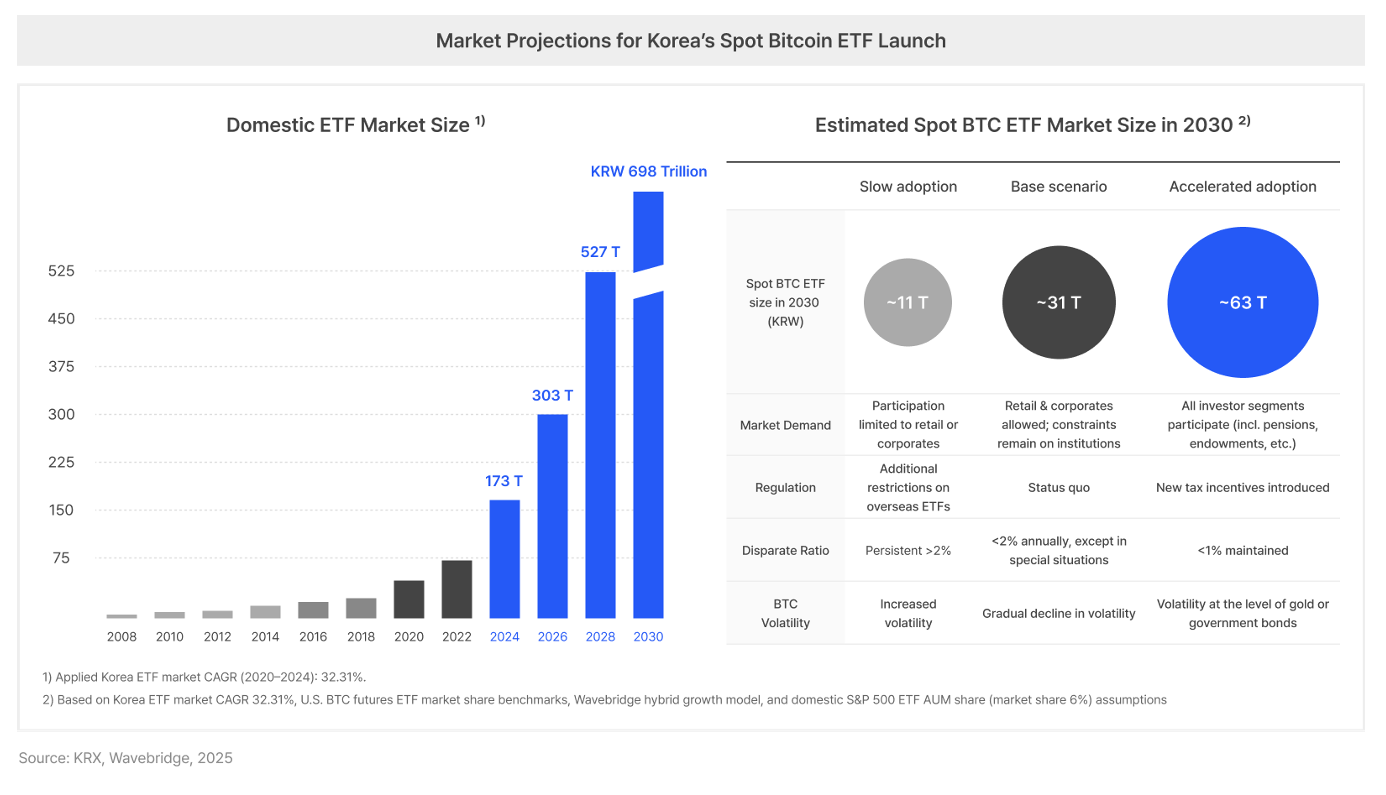

Globally, Bitcoin spot ETFs have already grown into a $130 billion (KRW 180 trillion) market, with Hong Kong, the UK, and other major financial countries granting approvals.

In Korea:

Wavebridge projects Korea's Bitcoin spot ETF market could reach KRW 63 trillion by 2030:

Bitcoin spot ETFs are not just another investment vehicle — they will act as a catalyst for both retail-to-institutional migration and wider adoption. Benefits include:

This marks the crossroads where retail transitions to regulated ETF exposure and institutions begin their full-scale entry. In time, derivatives markets may also emerge as a natural next step for risk management.

While the U.S. and Europe are leading the way with established stablecoin regimes, Korea is just beginning its regulatory discussions. Yet its fundamentals are uniquely strong.

Together, these form fertile ground for KRW-based stablecoins. Potential benefits include:

Challenges remain, such as alignment with the Bank of Korea’s CBDC program, regulatory coordination among agencies, and harmonization with global frameworks (MiCA, GENIUS Act). Still, stablecoins are not just an industry agenda — they represent a systemic need for greater financial efficiency.

Taken together, these dynamics show just how attractive Korea’s digital asset market is. Genuine retail demand already exists, and institutional frameworks are now being put in place. The question is no longer if the market will expand — but how.

For foreign entrants, strategic planning is essential. Four key points stand out:

(1) VASP License vs. Partnerships

Strategic partnerships: Enable immediate entry by leveraging existing VASP infrastructure and spreading regulatory risk. In practice, this phased, partnership-first approach is the most realistic.

New VASP license: Provides independence and brand control but typically requires over one year and at least KRW 5 billion(USD 3.65 million) in setup costs (staffing, IT, AML, real-name banking).

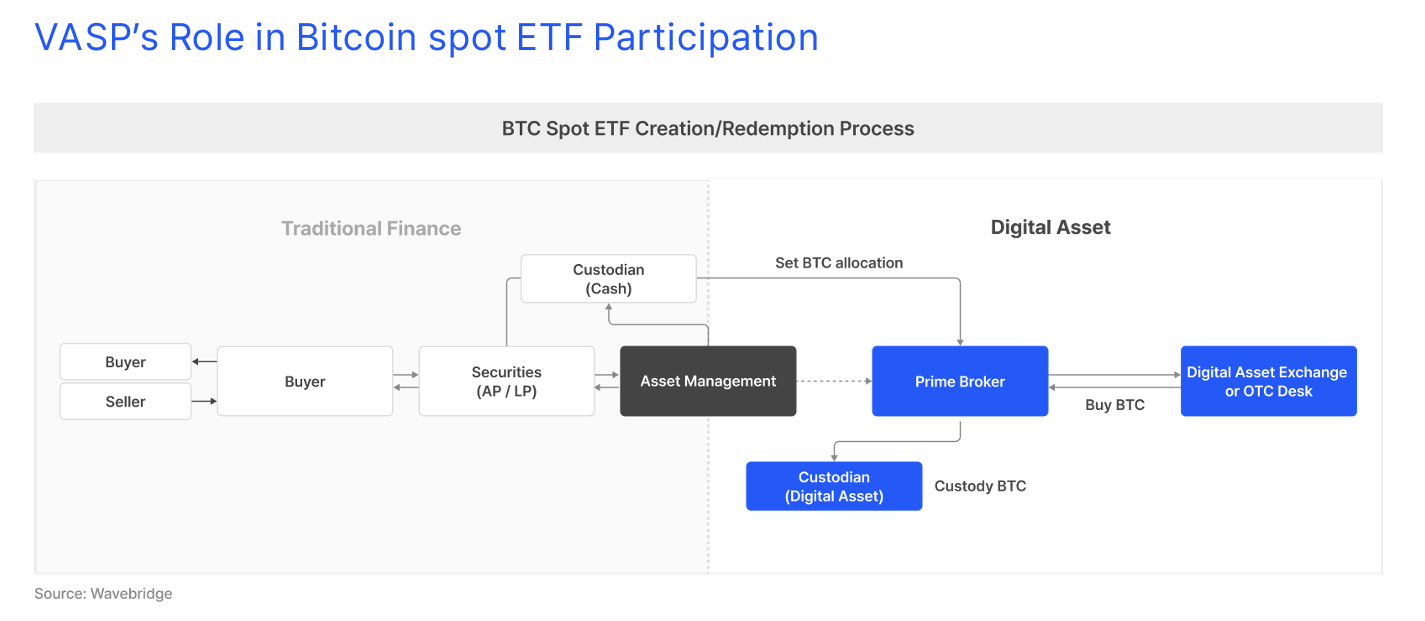

(2) VASP’s Role in Bitcoin Spot ETFs

Relying solely on exchanges risks conflicts of interest — independent prime brokers and custodians are required.

Beyond issuance and distribution, VASPs are essential for physical Bitcoin creation/redemption, large-scale custody, and institutional liquidity provision.

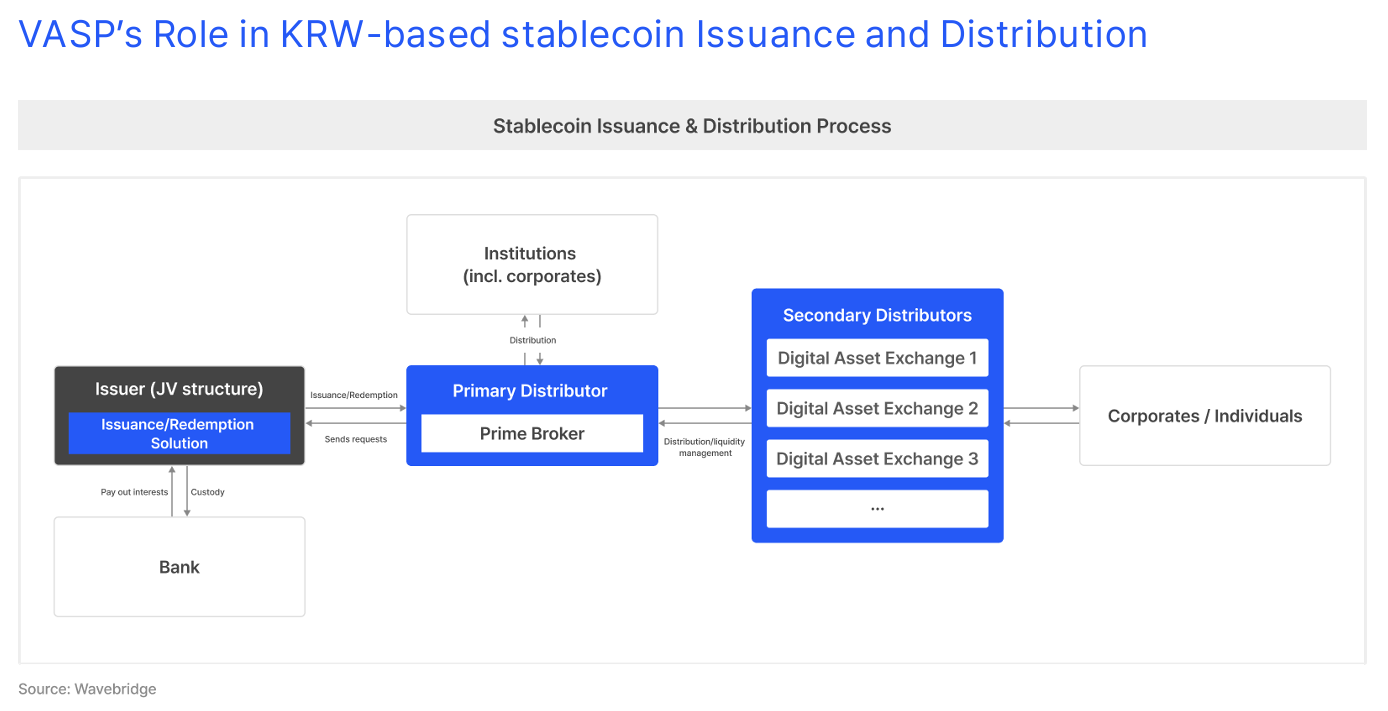

(3) VASP’s Role in KRW Stablecoin Ecosystems

Korea is moving toward a dual structure: bank-led JV issuers + digital asset distributors.

(4) A Phased Market Entry Strategy

Conclusion

For global firms considering entry, Korea offers a rare combination of proven retail demand and emerging institutional clarity.

Wavebridge is ready to serve as a trusted partner — combining regulatory alignment, infrastructure expertise, and global perspective — to help institutions navigate Korea’s pivotal crypto shift and grow together in this expanding market.